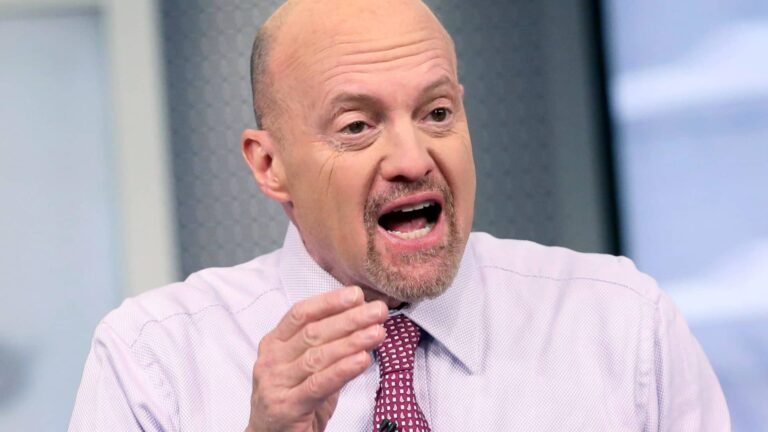

CNBC’s Jim Cramer on Wednesday discussed a couple broad ideas that he thinks are driving market action, saying it’s important to understand trends and impactful current events.

“You know why I first got into this whacky business? Stories, stories that’s why,” Cramer said. “Tremendous, intriguing stories, tales that could explain what’s going to happen — and you could actually make a little money from them. That’s what’s happening right now, and the stories are driving much of this action.”

According to Cramer, Wall Street is at “an inflection point.” He said investors can focus on “minutiae,” like job losses in healthcare, moves in the 10-year Treasury or commentary from different members of the Federal Reserve. Or, he said, “we can keep an eye on all of that but focus on some stories that can make us some money.”

Cramer first pointed to developments in global trade regarding Vietnam. He described how President Donald Trump slapped Vietnam with a hefty tariff on his so-called “Liberation Day” back in April. The move came as a blow to many major companies who had rushed to move manufacturing from China to Vietnam to appease Trump, he said. Since then, Cramer continued, many apparel and furniture companies have seen their stocks take a hit as they face supply chain upset.

However, Trump on Wednesday announced that the U.S. struck a trade deal with Vietnam that established a lower tariff on goods than he has initially threatened. A number of stocks jumped at the news, Cramer said, including Nike and Williams-Sonoma. He also named Gap, Levi Strauss and Kontoor Brands — which owns Lee, Wrangler and Helly Hansen — as potential winners.

Another notable trend Cramer identified is the weakness of the dollar, which reached a four-year low. Cramer said he thinks this weakness is positive for consumer packaged goods’ companies like Procter & Gamble, because it makes their exports more competitive.

“Now, I don’t like Procter & Gamble stock that much here, but it’s pretty obvious they’ll be able to beat the numbers thanks to the weaker dollar,” he said.