Amid heated criticism from former President Donald Trump, Goldman Sachs is standing firm on its projection that American consumers will soon absorb the majority of the costs from newly imposed tariffs.

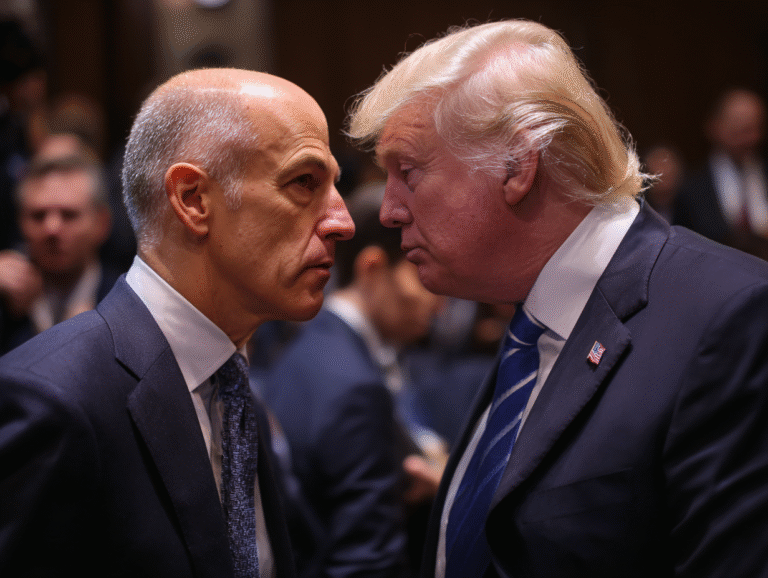

In a televised interview, David Mericle, a leading economist at the investment bank, reaffirmed the company’s stance following a public rebuke from Trump on Truth Social. The former president had called on Goldman CEO David Solomon to either “get a new economist” or resign, after Goldman released a research note suggesting tariffs would soon start hitting everyday Americans’ wallets.

Consumers Could Bear Two-Thirds of the Cost

Despite the backlash, Mericle was unapologetic:

“We stand by the results of this study,” he said. “If these new tariffs follow previous patterns, by the fall, we estimate that consumers will bear about two-thirds of the total cost.”

The forecast is based on modeling by economist Elsie Peng, who authored the weekend note that ignited the controversy. While businesses and exporters have largely shouldered tariff impacts so far, Goldman expects the pressure to shift to consumers over the next few months.

Peng’s analysis also indicated that this shift could push the core personal consumption expenditures (PCE) inflation—the Federal Reserve’s preferred inflation gauge—to 3.2% by year-end, up from its current level of 2.8%. The Fed’s long-term target for inflation remains at 2%.

Goldman Says the Data Supports the Forecast

Mericle argued that the predictions aren’t outliers, noting that Goldman’s research aligns with findings from other economists.

“Companies that are shielded from foreign competition due to tariffs may take advantage by raising prices,” he added. “That dynamic is part of how the cost gets passed on.”

What It Means for the Fed

Interestingly, despite predicting rising costs, Mericle still believes the Fed is likely to deliver interest rate cuts this year—something Trump has aggressively pushed for.

“The labor market is the Fed’s main concern right now. This tariff-driven price increase is a one-time event in our view, and won’t significantly change the Fed’s long-term trajectory,” Mericle explained.

Weaker-than-expected job data from July, along with modest increases in the Consumer Price Index, have already led markets to anticipate rate cuts at all three remaining Federal Reserve meetings this year.

Summary:

Goldman Sachs is unwavering in its view that U.S. consumers will ultimately feel the pinch of Trump’s tariffs, despite the former president’s sharp rebuke. With inflation pressures building and economic uncertainty ahead, all eyes now turn to how the Federal Reserve will balance consumer strain with labor market weakness.