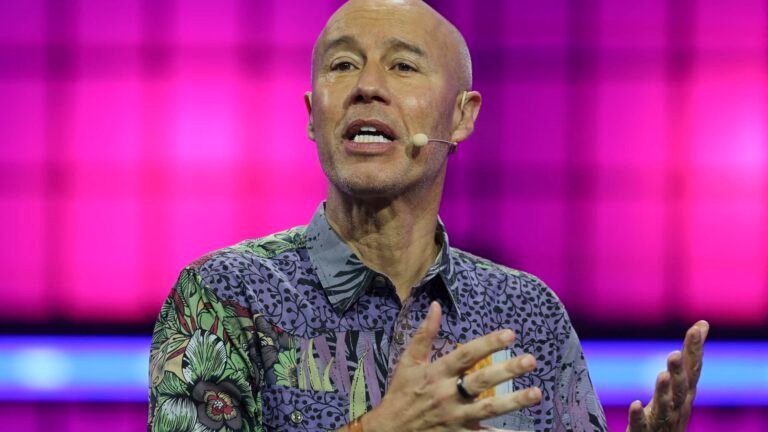

Lyft CEO David Risher defended the company’s fourth-quarter results Wednesday, telling CNBC that consumer demand remains strong.

“We have record profits, generated over a billion dollars in cash, and that’s a result of our customer-obsessed strategy, which just keeps working and growing the company,” he told CNBC’s “Squawk Box.” “So, love what we’re seeing, and really no softness on the consumer side at all.”

Shares sank 15% Wednesday as ridership numbers disappointed Wall Street.

The ride-sharing company reported 29.2 million active riders for the quarter, falling short of 29.5 million expected by analysts. Rides totaled 243.5 million for the period, missing estimates of 256.6 million.

Risher highlighted Lyft teen accounts and the company’s acquisition of European taxi app FreeNow as future growth drivers for the company. Lyft’s launch of teen accounts on Monday came more than two years after rival Uber.

Lyft issued soft first-quarter guidance, expecting bookings to fall between $4.86 billion and $5 billion, versus a FactSet estimate of $4.93 billion. The company projected an adjusted EBTIDA of $120 million to $140 million, compared to a FactSet consensus of $139.8 million.

As robotaxis continue to expand, Risher noted Lyft’s planned autonomous vehicle rollout.

“We’re positioned super well. We’ve got great partnerships with Waymo, with Baidu, with others,” Risher said. “We’ll be starting to bring some of their technology, some of their self-driving cars onto the roads in places like Nashville in 2026.”

Lyft’s fourth-quarter revenue fell in line with expectations at an adjusted $1.76 billion. The company reported an adjusted 16 cents in earnings per share, beating expectations of 12 cents.

Both revenue and earnings per share had several exclusions and adjustments.

Risher also drew attention to Lyft demand during the Super Bowl, which he said had 13 to 15% volume growth year over year, with faster pickups and lower surge pricing than competitors.