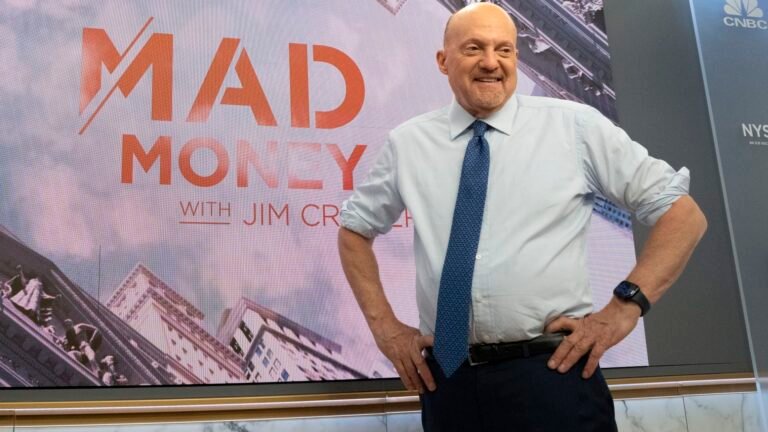

CNBC’s Jim Cramer on Friday walked investors through next week’s market action, honing in on a keynote speech from Nvidia‘s Jensen Huang and earnings from retail names including Target, Ralph Lauren and TJX. He struck an optimistic tone about the market’s capacity to secure gains — as long as trade tensions don’t worsen between the U.S. and China.

“Unless we get news of new hostilities in the trade war with China, I think this market’s propensity will still be to go higher, even though we are overbought,” he said. “And even with this late night credit rating downgrade of the U.S. debt – which is very quizzical to me – I think we’re containing the downside of the economy, and that means no recession, which tells me the negativity may be out of synch with the reality.”

On Sunday, Huang is expected to give a keynote speech at Computex, an artificial intelligence conference in Taiwan, where Cramer said he expects to hear about new ideas and products. He emphasized that Nvidia is rebounding off its lows and managed to bring its market cap back above $3 trillion. But he said he wouldn’t be surprised if the stock has room to run.

JPMorgan will host an investor day Monday, and Cramer said the event has market-moving potential. Capital One is expected to finalize its merger with Discover Financial on Monday, and Cramer said he thinks the credit card company’s stock could keep moving, even after its recent gains.

Tuesday brings earnings from Home Depot, Toll Brothers and Palo Alto Networks. While Cramer said he’s not expecting a blowout quarter from Home Depot, he likes the stock for the long term, and it has the scale to weather new tariffs. He also praised peer retailer Lowe’s, which is set to report on Wednesday. According to Cramer, Wall Street has soured on the home builders. However, he said he’s expecting a solid quarter from Toll Brothers that could energize its stock, even if management issues somewhat restrained guidance. Palo Alto Networks has a habit of declining after its quarter, even if results are good, Cramer claimed, suggesting investors wait to buy it.

Apparel companies TJX and VF Corp will report Wednesday, and Cramer noted that the former also seems to go down after a positive quarter. He said TJX is one of the better retail names at the moment because of its discounted offerings. VF Corp disappointed with its last quarter, Cramer said, but he expressed faith in CEO Bracken Darrell, saying it might worthy building position in the company and buying into weakness.

Wednesday also brings earnings from Target, which Cramer indicated is one of the more “problematic” retailers. He said it’s too hard to make a call on this stock, as he fears the company won’t offer a good forecast even if the quarter itself is fine. Medtronic, which reports on Wednesday, is also hard to game, he continued. The stock has been inconsistent, he said, even as he likes the medical device company’s products. He was optimistic about Snowflake‘s Wednesday quarter, praising the strength of the cloud outfit’s business.

On Thursday, Cramer will be keeping an eye on reports from Ralph Lauren, Deckers Outdoor and Intuit. Cramer was positive on Ralph Lauren, lauding its recent string of strong quarters and business acumen, and he advised buying the stock ahead of the quarter. He dubbed Intuit a “godsend for small business owners,” saying it’s a worthwhile investment even though it’s expensive right now. After seeing some promising news from other shoe retailers, Cramer was fairly sanguine on Deckers, which owns brands including Hoka and Uggs.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club holds shares of Nvidia, Home Depot, TJX, Capital One and Palo Alto Networks.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com