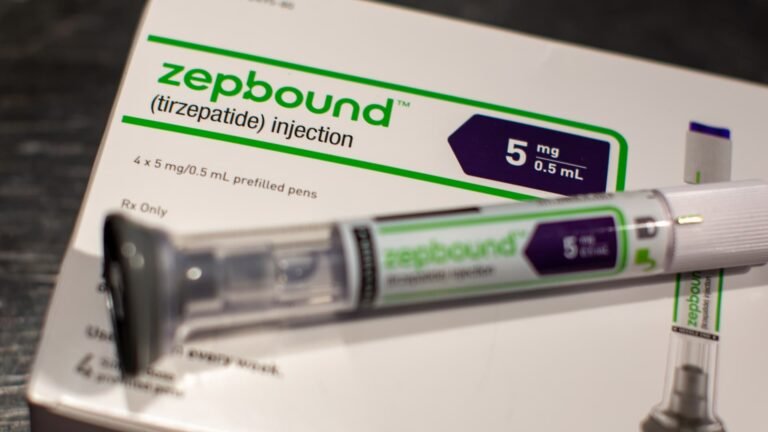

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street. Markets: Stocks are rallying on Tuesday, overcoming yet another premarket decline like we saw Monday. The data center and AI infrastructure trade — ranging from semiconductor stocks like Nvidia and Broadcom to industrials like GE Vernova and Eaton — is powering the market higher in reaction to Meta Platform’s 20-year agreement to buy nuclear power from Constellation Energy . The Club owns all these stocks, except for Constellation Energy. Meanwhile, there was no real news on the trade negotiation front. A big thing to watch on trade in the coming days is whether President Donald Trump and Chinese leader Xi Jinping do, in fact, hold a call. The White House has indicated such a conversation is likely to happen this week. Eli Lilly: JPMorgan reiterated its overweight rating and $1,100 price target on Club name Eli Lilly in a research note on Tuesday. The main takeaway from the note was that volume trends for Lilly’s GLP-1 drug portfolio — Zepbound for obesity and Mounjaro for type 2 diabetes — were running ahead of JPMorgan’s expectations, resulting in the analysts raising their already above-consensus revenue forecast for the second quarter. JPMorgan cited two factors behind the increased estimates: strong growth in the obesity market, with prescriptions up approximately 25% quarter over quarter, and Eli Lilly capturing nearly three-quarters of all new patient starts. Importantly, JPMorgan thinks this strong category and share growth will help Lilly’s prescriptions continue to grow despite the CVS formulary change to make rival Novo Nordisk’s Wegovy the preferred GLP-1 for weight loss. This goes into effect on July 1. However, according to Lilly, it is only expected to impact roughly a couple hundred thousand patients. JPMorgan also doesn’t think the Novo Nordisk and CVS deal will lead to a GLP-1 price war. The script trends and JPMorgan’s belief that Lilly can offset any CVS headwind is very encouraging — especially on the CVS angle because that bit of news has been a huge overhang on Lilly shares ever since it was announced May 1. The broader pharmaceutical group has also been under pressure due to uncertainty tied to possible sectoral tariffs and drug pricing regulation. Lilly stock had fallen more than 20% in the month of May before mounting a modest rally in recent days. We added to our Lilly position a few weeks ago at around $715 per share. Before Eli Lilly reports second-quarter earnings in August, the next major event is the 2025 American Diabetes Conference, taking place between June 20 to June 23. There are expected to be several high-profile data readouts and presentations at the conference. In a separate note by JPMorgan, the analysts said investors should watch out for the full late-stage trial results from Eli Lilly’s oral GLP-1 orforglipron. Eli Lily shares surged in April after GLP-1 pill was successful in a late-stage trial for type 2 diabetes, potentially paving the way for Food and Drug Administration approval in early 2026. Similarly, another readout to watch is more complete trial data for Novo Nordisk’s CagriSema, which is a combination of an amylin analog called cagrilintide along with semaglutide, the active ingredient behind Wegovy and Ozempic. It targets fat loss and was thought to be Novo’s next-generation product to follow up Wegovy. However, its preliminary trial results disappointed earlier this year. Amgen is also expected to release its mid-stage trial data on MarTide, which is a once-monthly GLP-1 injection. Finally, JPMorgan said we could see some data on one of Elil Lilly’s next-gen weight loss drugs, bimagrumab. That was one of the assets that Lilly acquired as part of its acquisition spree in 2023 , and muscle mass preservation is one of its distinguishing features. Up next: Club name CrowdStrike reports after the closing bell on Tuesday. The LSEG consensus estimate is for revenue of $1.10 billion and EPS of 65 cents. We expect management will reaffirm its outlook that net new annual recurring revenue growth will reaccelerate in the second half the fiscal year, driven by strong adoption of the Falcon Flex platform and the expiration of the Customer Commitment Package incentive program. Other companies report are Hewlett Packard Enterprise and Asana . Thor Industries and Dollar Tree report before the opening bell on Wednesday. On the economic data side, there’s weekly mortgage applications, the ADP private employment report, and ISM’s look at the services industry. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.