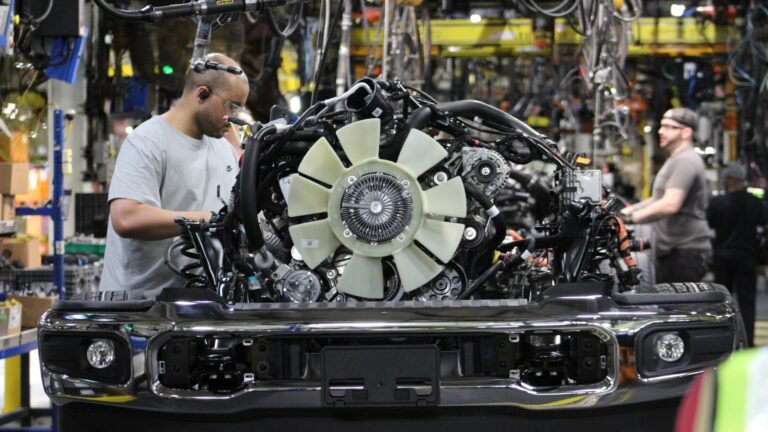

A worker at Ford’s Kentucky Truck Plant on April 30, 2025.

Michael Wayland | CNBC

DETROIT — The automotive industry is experiencing unprecedented disruption and uncertainty when it comes to regulations, electric vehicles, software innovations and competition from China.

Such disruptions have been years in the making, but many of the issues are coming to a head sooner rather than later, causing chaos for automakers and their plans for new vehicles.

“The unprecedented EV head-fake has wreaked havoc on product plans,” Top Bank of America Securities analyst John Murphy said in the firm’s annual “Car Wars” report. “The next four+ years will be the most uncertain and volatile time in product strategy ever.”

The proprietary “Car Wars” report predicts future products and plans over the next several years. The thesis of the report is that replacement rate (or the percentage of vehicles that are expected to be replaced by newer models) drives showroom age, which drives market share, which drives profits and stock prices.

Automakers above an industry average replacement rate of 16% over the next four years include Tesla (22.4%), Honda Motor (16.9%), Hyundai Motor/Kia (16.5%) and Ford Motor (16.1%), according to Car Wars. At the bottom end of the analysis are Nissan Motor (12.3%), Toyota Motor (13.7%) and traditional European automakers (15.2%). General Motors is at 15.7%, while Stellantis is at 15.4%.

Auto stocks

Aside from the replacement rates, Murphy on Wednesday made several predictions about the auto industry. Here are five investors should know about:

EV write-downs

Murphy expects the roughly $1.9 billion in expenses and write-downs Ford announced last year due to the termination of a planned all-electric three row SUV will be the first of many such losses for automakers regarding EVs.

“There’s a lot of tough decisions that are going to need to be made,” he said Wednesday during an Automotive Press Association event in suburban Detroit. “Based on the [‘Car Wars’] study, I think we’re going to see multibillion-dollar write-downs that are flooding the headlines for the next few years.”

Automakers rushed to spend billions of dollars in recent years for EVs in anticipation of a market that hasn’t developed as quickly as expected.

Return to core

Amid the EV uncertainty, many automakers have pivoted to “customer choice,” which means significant investments in other technologies such as hybrids and plug-in hybrid vehicles, as well as in traditional vehicles with internal combustion engines (ICE).

Due to that volatility and uncertainty, Murphy said automakers must lean heavily into their core products, including internal combustion engines, to generate capital.

“Really, everybody is leaning back into their into their core over the next four years in very uncertain times,” Murphy said, noting that cash “is going to be critically important” for automakers in the years ahead.

The title of this year’s “Car Wars” investor note underscores that change: “The ICE Age Cometh as EV Plans Freeze.”

China industry collapse

Industry uncertainty isn’t exclusive to the U.S. The Chinese auto industry — the world’s largest car sales market — is in the midst of a price war and stalling sales.

“What you’re seeing in China is a bit disturbing because there is a lack of demand; there’s extreme price cutting, and there’s a lot of export that’s rising, particularly over the last four or five years. Essentially net neutral to over 7 million units last year,” Murphy said.

The top BofA analyst described this as the Chinese market beginning to “implode on itself” due to the price war, which is expected to cause mass consolidation of China’s hundreds of automotive brands.

In China, the average car retail price has fallen by around 19% over the past two years to around 165,000 yuan ($22,900), according to a Nomura report this week, citing industry data from Autohome Research Institute.

Price cuts were far steeper for hybrid or range-extension vehicles, at 27% over the last two years, while battery-only cars saw prices slashed by 21%, the report said. It noted that traditional fuel-powered cars saw a below-average 18% price cut.

While very few exports come to the U.S., Murphy said it’s expected Chinese brands will eventually compete in the market. However, he cautioned it might be best to shield the U.S. market from Chinese brands in the near-term to avoid such issues domestically.

“I don’t think just from a technology or geopolitical perspective, that you really want to wall off the U.S. from China. It may be just simply that massive excess capacity you want to protect the U.S. market from until it works itself out and we see massive consolidation in the Chinese market,” he said, adding there’s good reason for massive tariffs on Chinese car imports.

Product shifts

“Car Wars” predicts there will be a shift in new vehicle introductions during the second half of this decade, as automakers refocus product lineups and slow replacement rates in the near term.

A major shift is in crossover vehicles — which have a combination of SUV and car characteristics — that have significantly grown in popularity in past decades.

Customers near a Ford Maverick pickup truck at a Ford dealership in Richmond, California, US, on Wednesday, April 16, 2025.

David Paul Morris | Bloomberg | Getty Images

BofA reports the crossover “surge is done.” For the first time nearly 20 years, Murphy said crossovers underrepresented versus the launch gains for the past 10 to 20 years.

“What’s wild this year is that we expect 159 models to be launched over the next four years. Last year was over 200; traditionally, it’s over 200,” Murphy said. “We have never seen this kind of change before.”

Part of the shift comes as the Detroit automakers — major producers of such vehicles — have focused on updating or redesigning their highly profitable full-size pickup trucks.

Japanese automakers have also had an uncharacteristically volatile product cadence, with a focus on cars, according to the report.

Auto growth area?

Investors have been skeptical of many auto stocks in recent years as expected growth areas have faltered.

But Murphy believes there’s still notable potential for automakers as well as their retailers in software — a focus area for companies as of late that also has not grown as much as initially expected.

“In the near term, it’s leveraging the connectivity, going after what we know is a very lucrative part of the value chain,” Murphy said. “They’ve been somewhat shut off from lack of attention to the consumer and a dealer body that needs to be reworked to some degree in a significant way, will create a real, real opportunity.”

The aftermarket industry and business at dealerships, including sales and service, represents $2.4 trillion in revenue, Murphy said. Of that $1.2 trillion captured by dealers, they generate about $53 billion in profits. He argues there’s another $1.2 trillion that’s escaping automakers, with $133 billion in profitability that could be gained through vehicle connectivity.

“It is vision critical that you get the dealers on board with this and drive this,” Murphy said regarding getting customers into dealerships instead of non-franchised repair shops.